The market is picking up in France — at least in the places we like to buy — and the exchange rate is in our favour, says local Anthony Peregrine reporting in The Sunday Times on 6th April 2014.

The good news sweeping in from France — or, at least, those bits of it favoured by Britons — is that the property market may be stabilising. In short, this may be your best chance for years to buy into rural France and annoy the hell out of everyone by raving about the joys of French village life. It drives listeners nuts. You know the sort of thing: marvellous little place, just like English villages were 50 years ago; nobody locks their doors; locals are so colourful; salt-of-the-earth neighbours always ready with a lettuce; you should see the village carnival... and so on and on, until you long for them to get hit by le TGV.

The truly irritating bit is that much of this is true. Let me tell you what I did last Sunday morning. After a sunshine stroll by vineyards and through garrigue scrub, I arrived at the village centre, then bobbed into the bakery for a baguette and, as it was Sunday, a cake or two. Generally I go for pets de nonne and têtes de nègre (respectively, nuns’ farts and negroes’ heads: France remains unrepentant in the pâtisserie department).

I bought meat from the general store and, from the tobacconist, the regional Sunday paper, which takes about three minutes to read. Then, in true weekender slacker’s mode, I joined those milling about the square, greeting some, avoiding others. As church came out in a flow of Sunday best, senior faithful surprised themselves, as they do every week, by noting there was time for an apéritif. I am easily led. After more minutes than necessary in the sunny, fuggy bar, I wandered home. There was a barbecue to light and the prospect of Sunday lunch.

I could go on about sports associations, full-blooded village fetes, the OAPs’ society and the fact that even the smallest of France’s 36,552 communes runs its own affairs, with a mayor and council. As I said, astoundingly irritating — and the particularly irritated might insist that there’s not much in the above that can’t be done in Britain. But, I’d argue, you couldn’t do it in such warmth, so routinely, or in a place comparably pleasant, anywhere I could afford to live. Whereas it’s all available in France, right now, and — here’s the point — at what remain knockdown prices.

The post-2008 slump in property values and sales lacked the drama that swept Spain. But, notably in rural areas, some drops have been startling, especially in pretty little towns in the profoundly rustic Creuse department. Pre-2008, there was a silly bubble. Prices were grossly overinflated. Then they dropped back to what they should have been, and then dropped some more — up to 30%. There have been some shockingly low deals.

Yet there are signs of change in early 2014, and even (whisper it gently) of an uptake. This is not what the headline national statistics are saying. These are predicting continuing bad times — or poor times, at best — with 4% drops and sales volumes falling, too. For the individual buyer, however, national figures are meaningless. They include cities, suburbs, towns and parts of the country where no foreigner would live unless obliged to.

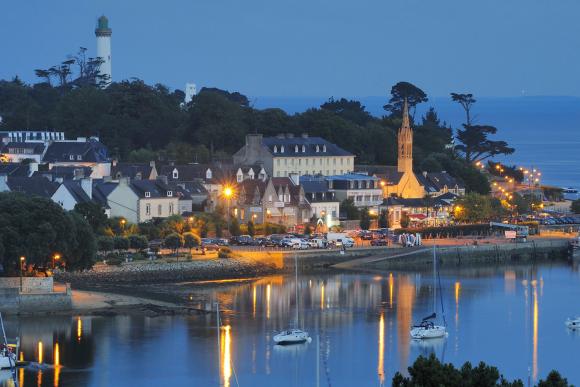

According to most agents, Britons these days are looking for bucolic properties mainly in the west and southwest — from Brittany down to Midi-Pyrénées, by way of Poitou-Charentes, the Limousin, Gascony and Aquitaine. In other words, they are intent on retaking, by stealth and property deals, land we lost in the Hundred Years’ War.

And here the market appears to be firming up, the past few months have seen signs of mild recovery, no stampede, as between 2000 and 2006 — it’s more of a crawl, but the strength of the pound has jolted people into thinking it’s make-your-mind-up time.

Most movement is around the €150,000 (£124,000) mark. That won’t buy you the rural idyll of a stone farmhouse with an acre of land, but it might get you close if you’re prepared to do some work.

Over in the Dordogne, things are also improving in loftier reaches — from €300,000 upwards. Late last year was the nadir, but in the past three months, inquiries and visits have picked up, especially from the UK.

There are reasons for all this. Britain’s economy appears healthier, so we’re more confident shelling out for the French house after which we’ve long been lusting. At the same time, hardly anyone trusts Spain, what with its vertical price dive and authorities itching to knock down seaside homes that upset them. Interest rates in France remain low (about 3% for a 20-year mortgage) and — an unexpected bonus — favourable rates of capital gains tax on second homes have been extended through to next August.

Now is a fantastic time to buy, there’s still oversupply — but that will even out over the next couple of years. In other words, you’re buying relatively cheap, with a decent expectation that properties won’t get cheaper — not in the west and southwest, anyway.

So there we are. Welcome to France. If you decide to have a crack, may I mention a couple of considerations? You’ll need an English-speaking estate agent and, ideally, an English-speaking notaire, the lawyer who handles the paperwork and charges handsomely for it. (Their average annual salary — admittedly boosted by big Parisian earners — is not far shy of £200,000.) Bite the bullet. There are pitfalls out there, and not all French sellers are as honest as they look. And they don’t look that honest.

Keep the mayor on side. He or she is the person who can smooth edges or render life rocky. Most are highly intelligent, deeply charming, extraordinarily helpful (this is “keeping the mayor on side” in action), and may appreciate an invitation to apéritifs.

Don’t be afraid of resentment. At some stage, some bloke whose family has lived in the village since 1567 will cut up rough against you as an immigrant. It happened to me when my red setter carelessly impregnated a neighbour’s standard poodle. “You immoral foreign b******” was the least of it. Yet most of the village saw the flaw in his reasoning, life carried on, and, a few years’ later, the poodle-owner and I now exchange bonjours.

Avoid feuds. Every village has them, especially those in remoter spots. A history of tough living hasn’t always disposed inhabitants to love all their fellow men. Boundary disputes last for generations. Smile at everyone, but keep well clear. I’ve known people who are not above poisoning enemy neighbours’ dogs.

Finally, if you don’t speak French, consider learning. Otherwise you’ll be confined to an expat ghetto and will miss the essence of local life. Imagine a Frenchman moving to Derbyshire, unable to speak English. Derbyshire people would find this odd. They might even grow annoyed that this person comes into their shops and pubs and talks at them in French (and, Lord knows, Derby folk are tolerant).

This is the same as monoglot Britons living in Aquitaine. We may be numerous — 20% of house purchases in the Dordogne last year — but this is not our country. We are also famously polite. It’s not easy, but we know where our duty lies.

NOTE: The bulk of this article was originally published in The Sunday Times "Home" Section on 6th April 2014.

Blog submitted by: David at The French Property Network - Cle France.